คำถามที่พบบ่อยเกี่ยวกับการระดมทุนจากใบแจ้งหนี้

สอบถามข้อมูลทั่วไป

เมื่อคุณส่งมอบสินค้าหรือให้บริการแก่ลูกค้าแบบมีเครดิตเทอม โดยปกติคุณจะต้องยึดตามเงื่อนไขการชำระเงินที่ตกลงกันไว้ ซึ่งอาจอยู่ระหว่าง 30 ถึง 120 วัน เพื่อรอรับการชำระเงินของคุณ

การระดมทุนจากใบแจ้งหนี้ จะช่วยให้คุณได้รับเงินล่วงหน้าทันที 80% ของยอดใบแจ้งหนี้ โดยไม่ต้องรอเงื่อนไขการชำระเงินจากลูกค้าของคุณ ซึ่งจะช่วยให้คุณสามารถบริหารจัดการลูกหนี้การค้าได้โดยไม่ต้องกังวล!

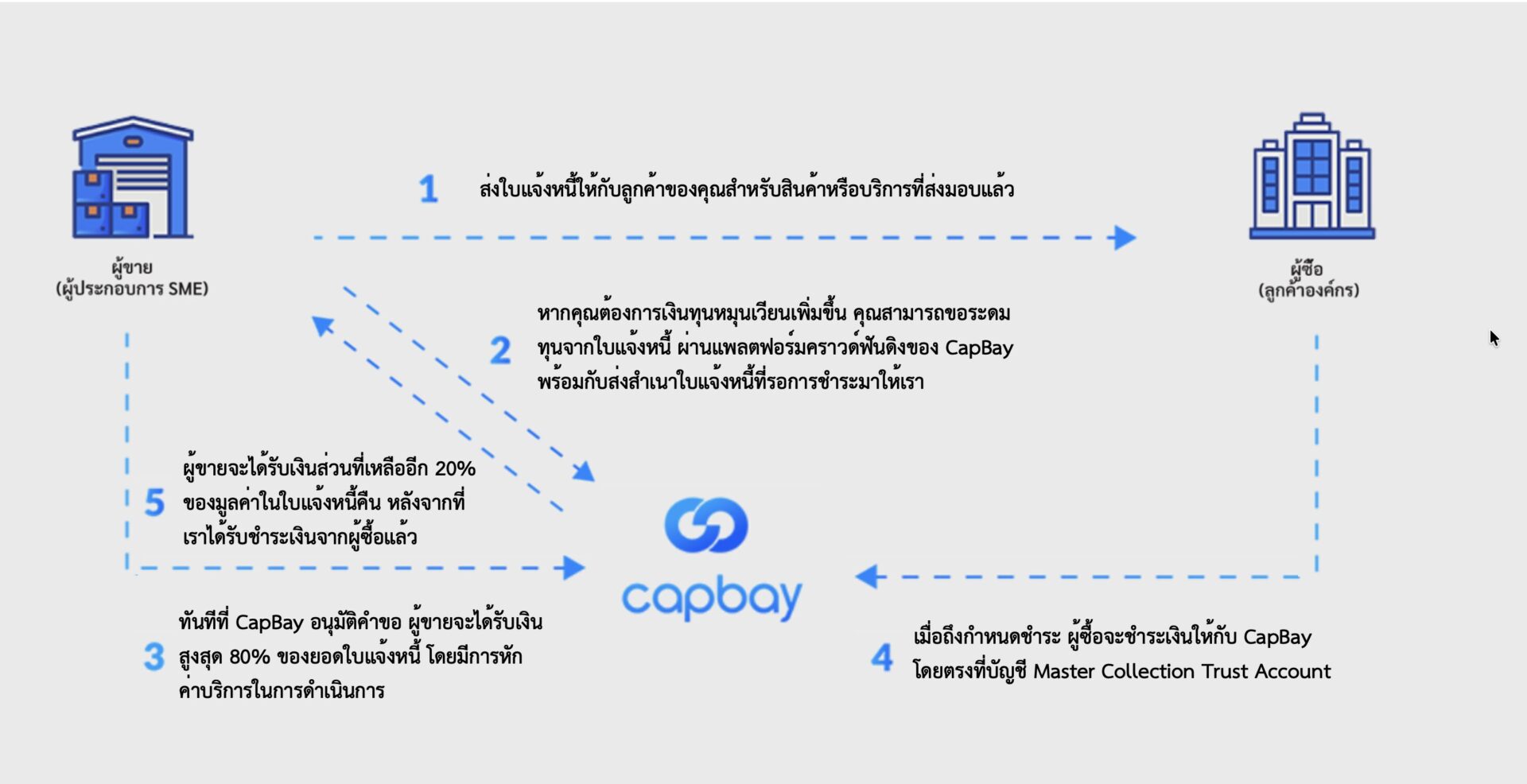

โปรดดูภาพประกอบด้านล่างเพื่อทำความเข้าใจกระบวนการการระดมทุนจากใบแจ้งหนี้ของ CapBay:

- การระดมทุนจากบัญชีลูกหนี้ทั้งหมด หรือเพียงบางใบแจ้งหนี้

- คุณสามารถนำบัญชีลูกหนี้ทั้งหมดเข้าระบบ CapBay โดยรับการระดมทุน เพียงใบแจ้งหนี้บางส่วน หรือจะใช้ใบแจ้งหนี้ทั้งหมดเพื่อเพิ่มสภาพคล่องทางการเงินให้มากขึ้นก็ได้

- การควบคุมเครดิต

- การบริหารเครดิตโดยผู้ให้บริการแพลตฟอร์มคราวด์ฟันดิงบางราย อาจกระทบต่อความสัมพันธ์ที่ดีระหว่างคุณกับลูกค้า

- ธุรกิจของคุณให้บริการหรือสินค้าแก่บริษัทคู่ค้าในประเทศไทยโดยมีเงื่อนไขการให้เครดิต (รูปแบบธุรกิจระหว่างบริษัท)

- คุณมีลูกค้ารายใหญ่หรือขนาดกลางที่เป็นบริษัทเอกชน

- บริษัทของคุณมีรายได้ต่อปีมากกว่า 1.5 ล้านบาท

- คุณเป็นนิติบุคคลที่จดทะเบียนในประเทศไทย (บริษัทจำกัด, หรือ บริษัทมหาชน ที่ไม่ได้จดทะเบียนในตลาดหลักทรัพย์)

- บริษัทของคุณมีคนไทยเป็นเจ้าของหลัก (มากกว่า 51%) และเปิดดำเนินการมาแล้วอย่างน้อย 1 ปี

*แม้คุณจะไม่ตรงตามเกณฑ์ที่กำหนดไว้ คุณยังสามารถขอใบเสนอราคาได้ เราจะพิจารณาใบสมัครของคุณเป็นรายกรณี โดยไม่สามารถรับประกันผลการอนุมัติ

สำหรับลูกค้าใหม่ จะมีขั้นตอนการสมัครเพิ่มเติมซึ่งใช้เวลาประมาณห้า (5) วันทำการ

- ค่าธรรมเนียมการสมัคร: ค่าธรรมเนียมจัดตั้งวงเงิน, 1.00% – 3.00% ของวงเงินอนุมัติ

- ค่่าธรรมเนียมแพลตฟอร์ม: ค่าธรรมเนียมการดำเนินการ: 0.50% – 1.50% ของมูลค่าใบแจ้งหนี้ (Invoice)

- ค่าธรรมเนียมส่วนลด: 0.50% – 1.75% ต่อเดือนของยอดเงินทุน (6% – 21% ต่อปี)

- ไม่มีค่าใช้จ่ายหรือค่าธรรมเนียมแอบแฝง

คำถามที่เกี่ยวข้องกับประเภทธุรกิจ

ผู้รับเหมาหลักเป็นบริษัทขนาดใหญ่ที่มักจะเข้าถึงแหล่งเงินทุนได้กว้างกว่า นอกจากนี้ยังอยู่ในฐานะที่ไม่จำเป็นต้องสำรองเงินทุนหมุนเวียนจำนวนมากไว้เอง เนื่องจากพวกเขาจะไม่จ่ายเงินให้ผู้รับเหมาช่วงจนกว่าจะได้รับเงินจากลูกค้า

โดยปกติ ผู้รับเหมาช่วงจะเป็นบริษัทขนาดเล็กกว่าและต้องการเงินทุนหมุนเวียนจำนวนมหาศาลเพื่อใช้ในการซื้อวัสดุก่อสร้างและจ่ายค่าแรงก่อนที่จะได้รับเงินจากผู้รับเหมาหลัก ปัญหาที่บริษัทก่อสร้างต้องเผชิญคือข้อจำกัดของตัวเลือกทางการเงิน เนื่องจากความท้าทายที่ผู้ให้บริการแพลตฟอร์มต้องเผชิญในการพิจารณาการขอระดมทุนให้กับผู้ประกอบการ SMEs

ประเภทของการระดมทุน

อย่างไรก็ตาม ธนาคารจะเรียกเก็บค่าธรรมเนียมจากวงเงินเบิกเกินบัญชีเต็มจำนวน 7.5 ล้านบาท ดังนั้น คุณจึงจ่ายดอกเบี้ยเป็นสองเท่าสำหรับเงิน 3.25 ล้านบาทที่กู้ยืมไป ในทางตรงกันข้าม การระดมทุนผ่านแพลตฟอร์มคราวด์ฟันดิงของ CapBay จะคิดค่าธรรมเนียมเฉพาะจากเงิน 3.25 ล้านบาทที่คุณกู้ยืมไปเท่านั้น

(การแปลงหนี้การค้าเป็นเงินทุน): สมมติว่าบริษัท A ใช้บริการการแปลงหนี้การค้าเป็นเงินทุนในอัตรา 12% ต่อปี ซึ่งเท่ากับ 1% ต่อเดือน อย่างไรก็ตาม หากบริษัท A ใช้บริการนี้เพียงสองครั้งในปีนั้น ก็จะต้องจ่ายดอกเบี้ยเพียง 1% ในแต่ละเดือนที่ใช้บริการตามระยะเวลาของใบแจ้งหนี้ บริษัท A ไม่จำเป็นต้องจ่ายดอกเบี้ยสำหรับเดือนที่ไม่ได้ใช้บริการ การระดมทุนจากใบแจ้งหนี้ จะคิดค่าธรรมเนียมก็ต่อเมื่อมีการใช้บริการเท่านั้น